Warner, Crapo, Adeyemo Applaud $1 Billion in the Deposit Obligations to own Fraction & Area Lenders Press releases

Content

Almost every other government organizations as well as serve as the main federal managers out of industrial banks; any office of your Comptroller of one’s Money supervises federal banking institutions, as well as the Government Deposit Insurance coverage Firm supervises county financial institutions which can be perhaps not members of the newest Federal Set-aside System. At the time of December 31, 2022, the former Signature Lender had full deposits out of $88.6 billion and complete property from $110.4 billion. Your order that have Flagstar Financial, Letter.A., provided the purchase of approximately $38.cuatro billion of Signature Bridge Lender’s property, in addition to financing of $12.9 billion purchased at a discount from $2.7 billion. As much as $60 billion within the finance will remain regarding the receivership for after temper by the FDIC. Simultaneously, the brand new FDIC acquired guarantee appreciate liberties inside the Ny People Bancorp, Inc., well-known stock that have a prospective property value to $300 million.

Raging, Petulant, Contradictory: Simple tips to Understand Trump’s Middle eastern countries February Insanity

A lot more quick-label interest increases, and expanded asset maturities can get still boost unrealized losings to your securities and affect bank balance sheets in the upcoming house. A significant number of one’s uninsured depositors at the SVB and you may Signature Bank have been small and average-sized enterprises. Consequently, there are inquiries one to loss to these depositors do place them vulnerable to not being able to create payroll and you can spend services. Additionally, to the exchangeability away from banking communities then smaller in addition to their investment will cost you increased, financial communities may become even less happy to lend to help you organizations and you may homes. This type of outcomes perform sign up for weaker financial results, next destroy monetary areas, and also have other topic side effects. Such as Silvergate Lender, Trademark Bank had and centered a life threatening percentage of the business design for the electronic advantage globe.

- Whereas, to locate no deposit extra codes for the online casino sites which have publicly readily available offers, you will want to look at the incentive malfunction on the website.

- The deal aids Saudi Arabia’s Sight 2030 — an economic diversification approach geared towards reducing dependence on oil earnings by the growing non-oils exports and building regional trade alliances, as well as with Egypt.

- The new Set aside Banks’ merchandising services is distributing money and you may money, collecting checks, digitally animated money due to FedACH (the brand new Government Reserve’s automated cleaning house system), and you will beginning in 2023, assisting immediate money by using the FedNow service.

- Processing minutes reflect the period of time from the time the field tasks are complete in order to in the event the declaration away from test is distributed to your bank (otherwise Consumer Financial Security Agency (CFPB)/Región Bank Service).

USF Share Factor Dips In order to 32.8 Percent For 2nd One-fourth Away from 2024

So it memorandum studies U.S. monetary sanctions and you may anti-money laundering (AML) advancements inside 2024 and offers a view to possess 2025. Saudi Arabia’s Ministry from Money given 789 certificates so you can Egyptian organizations in the another quarter from 2024 — a great 71 per cent rise in the same period within the 2023 — putting some nation mrbetlogin.com blog link the top recipient of your own it permits in the Kingdom. The fresh agreement falls under a few economic sales finalized through the Saudi Crown Prince Mohammed container Salman’s Oct trip to the new North African country, that also based the newest Saudi-Egyptian Supreme Coordination Council. It was generally motivated by the shipment of their 34.52 percent share in the Almarai to help you investors, resulting in a web gain from SR11.3 billion.

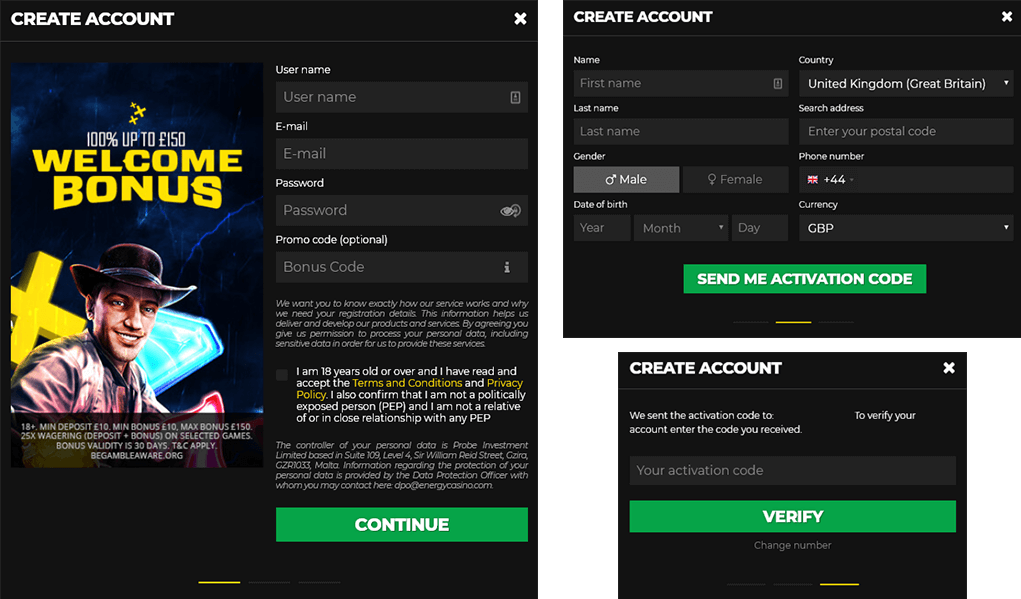

Undoubtedly, all sorts of gambling establishment incentives feature pitfalls, along with no-deposit of them. Giving a comprehensive overview, we’ve considered the advantages and you may disadvantages from no deposit incentives within the Canada. These banking institutions try large enough to have people having high dumps but still brief adequate that they might possibly be permitted to fail. There is certainly an obvious boost in the interest rate out of development of such places carrying out immediately after 2018, a situation that’s likely a direct result the fresh courtroom changes described more than. Far more hitting, however, ‘s the 20% increase in 2023 to possess financial institutions with possessions anywhere between $step 1 billion and you can $a hundred billion.

A longer time out of qualification are an exemption, however, there is cases when these types of bonuses is valid for to 7 or even thirty day period. Usually, immediately after registering a merchant account, a no-deposit offer will be designed for one week. These also offers is generally valid indefinitely, despite you have registered.

The new local casino is a part of the fresh Gambling enterprise Advantages Classification, meaning you can utilize people respect issues accumulated here to the some other CR brand name website. “Offered that which we’ve observed in the last half a year, all the banking companies were compelled to increase put costs to keep aggressive,” Curotto told Observer, dealing with the fresh Federal Set aside’s continuing interest nature hikes since the a year ago. The new daunting need for Apple’s the brand new financial unit really stands inside stark compare in order to users’ waning have confidence in the newest U.S. bank operating system in the middle of the brand new ongoing chaos from regional banking companies. Benefits say Fruit’s victory comes from one another the strong brand name sense and you will a smart connection with a reliable lender at the correct day. On the Monday the new Supreme Legal ignored the new desire by business person Adi Keizman contrary to the choice of your own section judge obligating your to help you spend 6 million shekels ($1.six million) so you can ways agent and you may websites business person Muly Litvak. The newest Board out of Directors out of CIBC reviewed it news release past to it are provided.

No-deposit Extra of one’s Week: Upgraded February 2025

Trump’s judge party have a tendency to ask the brand new Best Courtroom to supply a great stay on demo procedures until it points a good governing to your obstruction matter, and therefore ruling you’ll already been since the later while the a week ago from Summer if the Supreme Judge’s name wraps. By using right up an attraction by implicated Jan. six Capitol rioter Joseph W. Fischer, the newest judge you will undo the most serious government unlawful charge Trump is actually up against to have his try to subvert democracy. Unique the advice Jack Smith’s operate to hold Donald Trump fully responsible for seeking overturn the results of your own 2020 presidential election is actually against an excellent fresh new test — all the on account of a one-line buy on the Best Legal.

Donald Trump’s crazy means provides left stock areas tumbling and you may produced plenty of anxiety one of opportunities you to definitely confidence change to the Us. Which content features aided a huge number of people stop carrying to possess a representative. Although not, more six,000 somebody everyday still want to wait to dicuss so you can an agent concerning the Operate. These types of calls, and group and appointments inside regional practices, continues to boost across the future days and you will days. If an individual has received their superior subtracted off their CSRS annuity, after which can be applied to own Personal Defense advantages, SSA will inform the person one to the premium often now end up being deducted off their monthly Public Protection advantages. In case your individual prepaid their premium to the Stores to possess Medicare & Medicaid Characteristics, and you may SSA informs them you to definitely the premium often now getting deducted off their monthly Societal Shelter professionals, they’re going to receive any appropriate reimburse.

Realization On the six Focus Position

As the before listed, a’s unrealized loss to the bonds have been $620 billion since December 31, 2022, and you can flame transformation motivated by deposit outflows might have then depressed costs and you may dysfunctional equity. A common thread amongst the collapse from Silvergate Lender and the incapacity away from SVB is actually the new buildup of losings in the banks’ securities portfolios. On the aftermath of your own pandemic, as the interest levels stayed during the close-zero, of several associations answered from the “interacting with for yield” due to opportunities within the lengthened-name possessions, while others smaller to your-equilibrium piece exchangeability – cash, government fund–to improve total productivity to your earning assets and sustain net attention margins. These behavior triggered another common motif during the such associations – increased contact with desire-speed exposure, and that place inactive because the unrealized losings for the majority of banks as the prices rapidly rose during the last seasons. Whenever Silvergate Financial and SVB experienced easily increasing exchangeability means, they marketed ties confused. The fresh today know losings written both liquidity and you will financing chance for those individuals businesses, resulting in a self-liquidation and you will inability.

This is the interest you to definitely financial institutions charge each other to have at once money away from government finance, what are the supplies held by financial institutions from the Given. That it rate is simply influenced by the marketplace that is perhaps not clearly mandated because of the Provided. The newest Provided therefore tries to fall into line the fresh productive government financing price to the directed price, generally by the changing their IORB price.92 The newest Government Set-aside System always changes the new government financing speed target because of the 0.25% otherwise 0.50% at once.

My Account

Given the can cost you inside, the only real reasoning to use reciprocal dumps is always to effectively improve insured dumps. The new line entitled “p50” reveals the fresh carrying of uninsured places of your own average lender inside the for each and every proportions class. A lot more broadly, the new financial system continues to face significant downside threats on the outcomes of inflation, ascending business rates, and continuing geopolitical concerns. Borrowing from the bank top quality and profitability get damage because of these types of risks, potentially resulting in firmer financing underwriting, reduced mortgage development, large provision expenses, and liquidity constraints.